All Categories

Featured

Table of Contents

Picking to spend in the real estate market, supplies, or various other common types of possessions is prudent. When choosing whether you must buy accredited financier opportunities, you ought to stabilize the trade-off you make between higher-reward possible with the lack of reporting needs or regulatory transparency. It must be claimed that exclusive placements involve greater levels of risk and can on a regular basis represent illiquid financial investments.

Especially, absolutely nothing here ought to be translated to state or suggest that previous results are an indicator of future efficiency neither ought to it be analyzed that FINRA, the SEC or any type of other safeties regulatory authority authorizes of any of these securities. In addition, when assessing personal placements from sponsors or firms using them to approved financiers, they can supply no service warranties expressed or suggested as to accuracy, efficiency, or results gotten from any type of details supplied in their conversations or presentations.

The business ought to supply info to you via a document called the Exclusive Placement Memorandum (PPM) that uses a more detailed explanation of expenses and threats connected with taking part in the investment. Interests in these bargains are only offered to individuals who certify as Accredited Investors under the Stocks Act, and a as specified in Section 2(a)( 51 )(A) under the Firm Act or an eligible worker of the administration company.

There will not be any kind of public market for the Passions.

Back in the 1990s and early 2000s, hedge funds were recognized for their market-beating performances. Some have actually underperformed, specifically throughout the monetary crisis of 2007-2008, nonetheless. This alternative investing strategy has an one-of-a-kind method of operating. Typically, the supervisor of a mutual fund will certainly allot a section of their available assets for a hedged bet.

Private Real Estate Investments For Accredited Investors

A fund manager for a cyclical market may commit a part of the assets to supplies in a non-cyclical sector to counter the losses in case the economic climate tanks. Some hedge fund managers use riskier techniques like making use of obtained money to purchase more of a possession simply to increase their possible returns.

Similar to shared funds, hedge funds are properly taken care of by career financiers. Hedge funds can use to different investments like shorts, alternatives, and derivatives - Accredited Investor Real Estate Crowdfunding.

How long does a typical Accredited Investor Property Portfolios investment last?

You might choose one whose investment viewpoint aligns with yours. Do remember that these hedge fund cash managers do not come inexpensive. Hedge funds usually charge a fee of 1% to 2% of the possessions, in addition to 20% of the revenues which functions as a "efficiency charge".

High-yield investments attract lots of investors for their capital. You can acquire a possession and obtain compensated for holding onto it. Certified investors have extra chances than retail capitalists with high-yield financial investments and past. A greater variety provides certified investors the chance to get greater returns than retail investors. Approved investors are not your common investors.

Who offers flexible Real Estate Investment Networks For Accredited Investors options?

You need to satisfy at the very least among the complying with criteria to become an accredited capitalist: You must have more than $1 million total assets, omitting your main home. Service entities count as accredited investors if they have more than $5 million in assets under monitoring. You have to have an annual earnings that goes beyond $200,000/ year ($300,000/ year for partners filing with each other) You should be an authorized financial investment consultant or broker.

As an outcome, accredited investors have much more experience and money to spread out across assets. The majority of investors underperform the market, including certified capitalists.

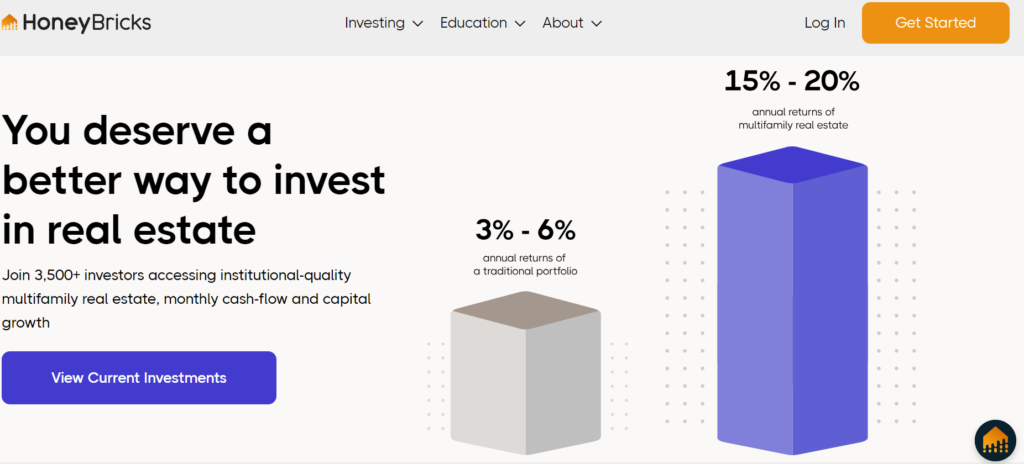

Crowdfunding offers recognized investors a passive duty. Property investing can aid change your revenue or cause a quicker retired life. In enhancement, financiers can develop equity via positive capital and home appreciation. Nevertheless, property homes require significant maintenance, and a lot can fail if you do not have the right team.

How much do Accredited Investor Real Estate Income Opportunities options typically cost?

The enroller discovers financial investment possibilities and has a team in position to take care of every duty for the building. Property syndicates merge money from accredited financiers to buy residential properties lined up with well-known goals. Personal equity realty allows you purchase a group of residential properties. Recognized capitalists pool their money together to finance purchases and residential property advancement.

Genuine estate investment trust funds need to distribute 90% of their taxed income to shareholders as dividends. REITs allow capitalists to expand swiftly across lots of residential property courses with extremely little capital.

Are there budget-friendly Real Estate Investment Networks For Accredited Investors options?

The holder can determine to apply the exchangeable alternative or to offer prior to the conversion happens. Exchangeable bonds enable financiers to purchase bonds that can end up being stocks in the future. Capitalists will certainly profit if the supply cost rises considering that convertible investments offer them a lot more eye-catching entry factors. Nevertheless, if the stock tumbles, financiers can opt against the conversion and safeguard their finances.

Table of Contents

Latest Posts

Back Taxes Foreclosure Homes

Tax Lien Investing Florida

Tax Foreclosure Homes

More

Latest Posts

Back Taxes Foreclosure Homes

Tax Lien Investing Florida

Tax Foreclosure Homes